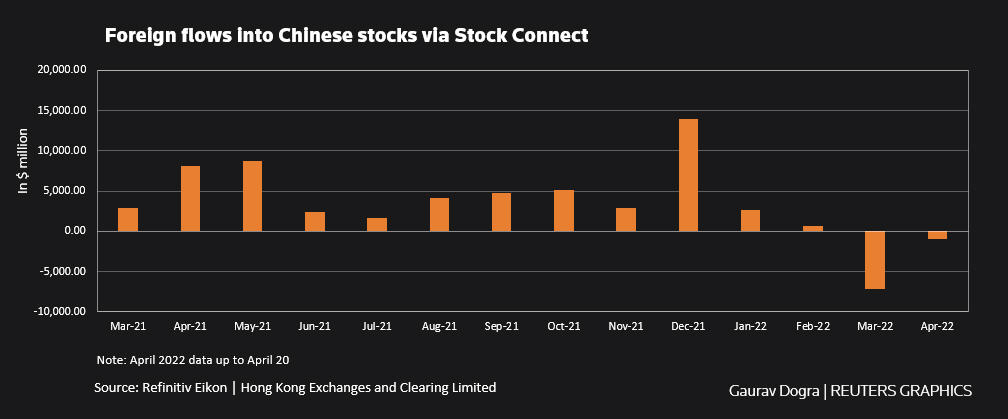

Overseas investors extended their selling of Chinese shares into April, after dumping them in the previous month, on mounting worries about the impact of prolonged COVID-19 lockdowns, growth and the fallout of the Ukraine-Russia war.

Foreign investors have sold a net $1.01 billion worth of Chinese equities so far this month via Hong Kong’s stock-connect program, after their sales of $7.1 billion in March, data from Refinitiv Eikon and the Hong Kong stock exchange showed.

Chinese shares (.SSEC), (.CSI300) have dropped nearly 5% so far in April, as strict COVID lockdowns in Shanghai and other big cities paralyses economic activity.

Mainland large and mid-cap stocks have fallen about 20% this year, making Chinese stockmarkets the world’s worst performers after Russia.

China’s top securities regulator said on Thursday that the economy remained healthy despite numerous challenges, asking institutional investors to invest more in equities to help limit short-term market fluctuations while contributing to economic restructuring.

Asset manager Schroders said the Chinese equity market valuation is now back to the troughs observed in March 2020 when COVID started and December 2018 when the U.S-China tensions were soaring.

“Given all the current uncertainties, patience will be needed in the face of the risks. A-shares could, however, be more resilient owing to the robust domestic investor base. They are also well positioned to benefit from greater policy easing.”

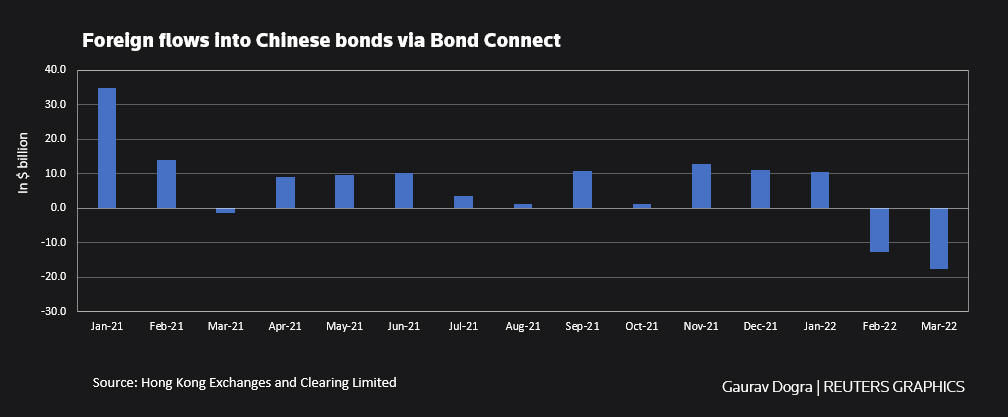

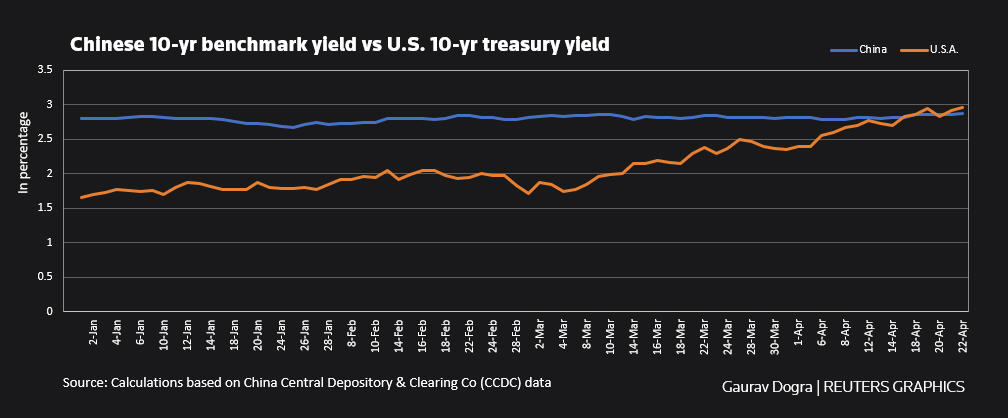

Bond investors remained on the sidelines mainly due to a surge in U.S. treasury yields that has eroded the premium on Chinese debt and also a swift drop in the yuan.

Last month, outside investors sold Chinese bonds worth $17.7 billion through Hong Kong’s Bond Connect, which was the biggest outflow since at least Aug. 2017.

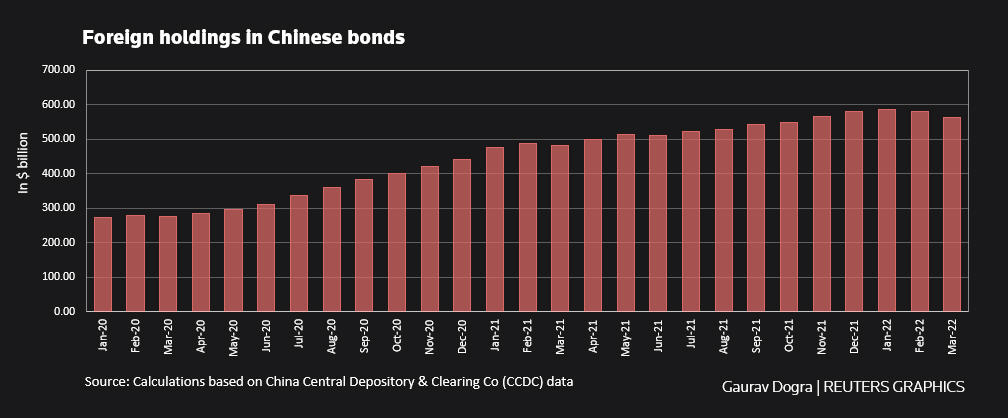

Foreign holdings of Chinese bonds stood at $3.57 billion at March end, the lowest in five months, data from China Central Depository & Clearing Co (CCDC) showed.

“Chinese government bonds (CGBs) are likely to see foreign holdings decline in the coming months as the CGBs’ yield advantage has disappeared alongside this year’s selloff in global bonds and expectations of aggressive rate cuts by PBOC are now low,” said Duncan Tan, strategist at DBS Bank.

“Global bond investors will likely consider the outperformance potential of CGBs to be much smaller going forward.”